Shares of Trump’s social media venture dropped by 21% on Monday, wiping out gains from its recent launch, due to financial reports showing substantial losses and concerns about future finances.

Trump Media & Technology Group reported a loss of more than $58 million in 2023. This news caused a sharp decline in the stock price shortly after its high-profile public offering through a blank-check merger.

Initially, the stock had surged on March 26, closing at nearly $58 per share, driven by enthusiasm from retail buyers, including supporters of Donald Trump.

However, Monday’s disclosure of significant losses reversed this trend, causing shares to fall by 21% to $48.66.

Analysts attribute the decline to the stock being overvalued and doubts about whether Truth Social can become profitable. Ross Benes from Insider Intelligence noted that the platform lacks clear ways to make money, which makes its initial high stock price unsustainable.

Despite the drop, Trump still owns a significant stake of 78.75 million shares, which could still bring in substantial profits, although less than originally expected. At its peak, his shares were worth over $6 billion, but now they are around $3.8 billion after the sell-off.

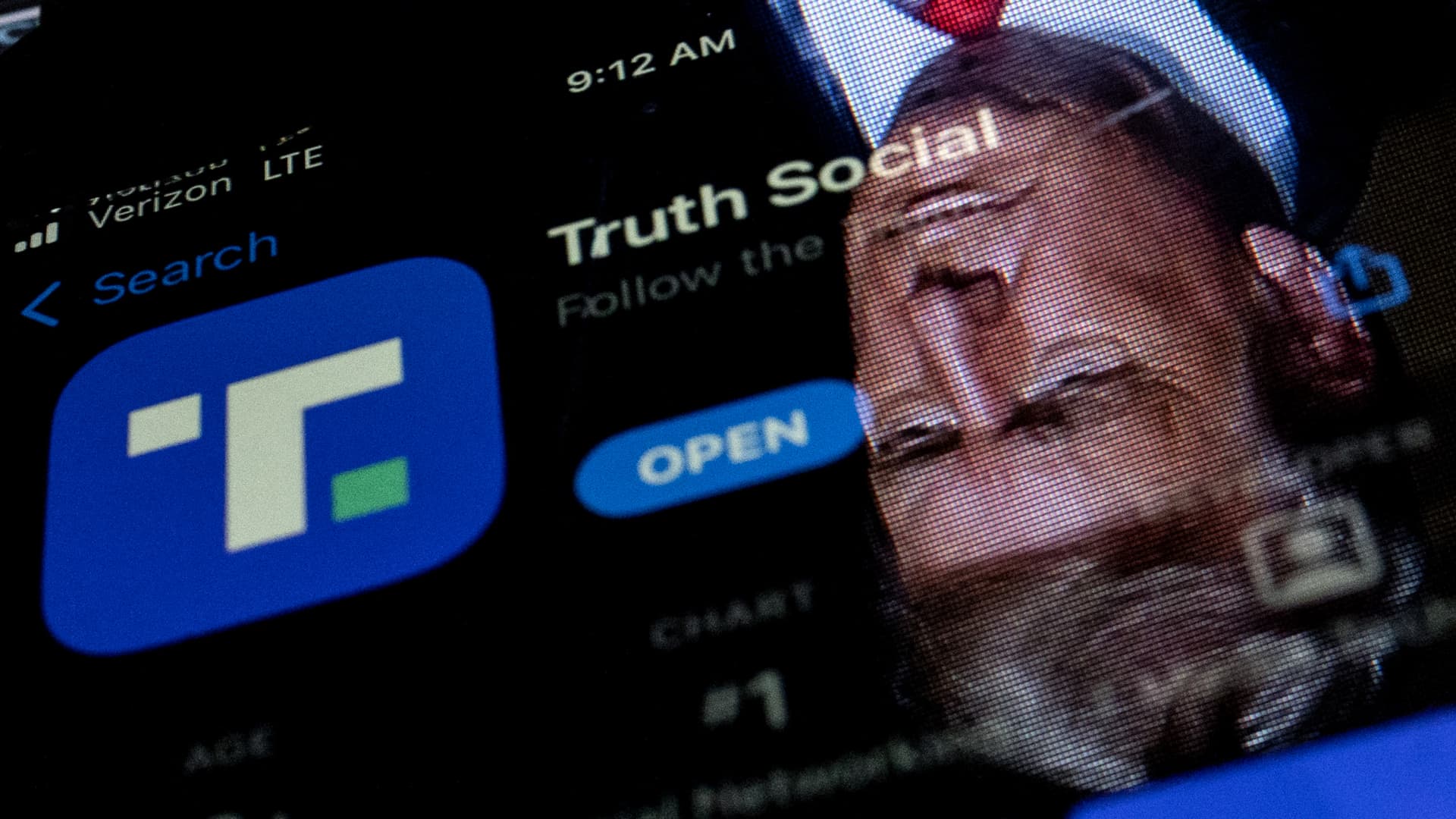

Analysts skeptical of Truth Social’s profitability (Via Tim Simmonds/Getty Images)

However, Trump cannot sell or use his shares as collateral for six months, which could lead to more selling attempts.

Even though the market value of the stock is still over $6 billion, comparing it to established platforms like Reddit, which has a market value of $8 billion, shows how Truth Social faces challenges in becoming a major social media competitor. Analysts point out that the platform is far behind established giants like Twitter, Instagram, and TikTok.

Short sellers who targeted Trump Media and its predecessor, Digital World Acquisition, made significant gains from Monday’s sell-off, recovering losses from earlier this year. There is still strong demand for shorting Trump’s venture, even though there are few shares available to borrow.

Despite revenue increasing to $4.13 million in 2023 from $1.47 million in 2022, Truth Social’s performance is still below industry standards. The company’s reluctance to share important metrics adds to doubts about its future in the market.

Trump Media also faces legal challenges with co-founders Wesley Moss and Andrew Litinsky, which complicate its operations.

A judge in Delaware has called for hearings to resolve ownership disputes, showing the difficulties Trump’s social media project will face moving forward.