Stocks fell and Treasury yields rose sharply on Friday after the government released a jobs report with higher-than-expected numbers. The report suggests that markets might have to wait longer for the Federal Reserve to cut interest rates.

The S&P 500 dropped 5.97 points, or 0.1%, to 5,346.99. This quiet end concluded a strong week where the index rose 1.3% and hit a record high.

The Nasdaq composite declined 39.99 points, or 0.2%, to 38,798.99, after gaining 2.4% for the week and reaching its own record high. The Dow Jones Industrial Average fell 87.18 points, or 0.2%, to 38,798.99.

Smaller company stocks, represented by the Russell 2000, fared worse with a 1.1% decline.

In May, U.S. employers added 272,000 jobs, surpassing economists’ expectations and showing a second consecutive monthly increase in the unemployment rate.

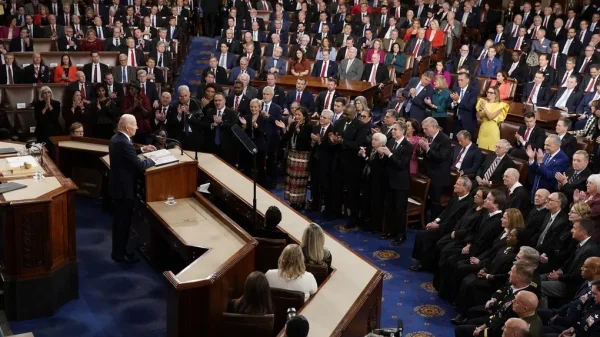

Michael Milano, center, works with colleagues on the floor of the NYSE (Via Robin Bates/Shutterstock)

Overall, the jobs market remains robust with some hints of slight weakening. While supporting consumer spending and the broader economy, this strength complicates the Federal Reserve’s decisions on interest rates.

The yield on the 10-year Treasury rose to 4.43% from 4.29% just before the jobs report release. The two-year yield, which reflects expectations for Fed actions, increased to 4.89% from 4.74% before the report.

Wall Street anticipates at least one cut in the Fed’s benchmark interest rate by year-end. The central bank had raised rates to their highest levels in over two decades to manage inflation, which has remained stubbornly around 3% despite significant drops in recent years. An enduring strong economy may continue to drive price increases.